Citibank credit cards give you simple cashback and travel rewards that match your spending habits.

You get clear benefits and flexible redemption options you can use right away.

This guide helps you understand each Citibank credit card and shows you how to apply without confusion.

Best Citibank Cash Back Cards

Citibank offers several strong cash-back cards, each suited to a different spending style.

This list gives you the main options so you can choose what works for you. Here are the top picks.

- Citi Double Cash® Card: Offers an unlimited 2% cash back rate (1% when you make a purchase, 1% when you pay it off)—no annual fee.

- Citi Custom Cash® Card: Lets you earn 5 % cash back on your highest-spend eligible category each billing cycle (up to a limit), then 1 % thereafter, plus unlimited 1 % on other purchases—no annual fee.

- Costco Anywhere Visa® Card by Citi: Great for Costco shoppers with tiered cash back and no annual fee for members.

Best Citibank Travel Cards

Citibank offers strong travel cards that let you earn points on flights, hotels, and everyday spending.

These options give you flexible rewards and valuable travel perks. Here are the top Citibank travel cards you can check.

- Citi Strata Premier® Card: Earns high points on hotels, rentals, and travel bookings.

- Citi Strata Elite℠ Card: Gives premium point rates and added travel benefits.

- Citi PremierMiles Card: Offers accelerated miles, lounge access, and no miles expiry.

Requirements to Apply

You need to meet a few basic requirements before you can apply for a Citibank credit card.

These help Citibank confirm your identity and check your ability to manage credit. Here are the key requirements you should prepare.

- Valid government-issued ID

- Proof of income (pay slips, tax documents, or employment papers)

- Active phone number and email address

- Minimum age requirement (usually 18 or 21, depending on your country)

- Stable residential address

- Good credit history or acceptable credit score

How to Apply for a Citibank Credit Card (Step-by-Step)

Applying for a Citibank credit card is simple when you follow clear steps. You can apply online, via the mobile app, or in person at a branch.

Here’s a quick breakdown of how you can complete the application.

- Visit the Citibank Website – You go online and choose the card you want.

- Click Apply Now – You start the application process.

- Fill out the Application Form – You enter your personal and financial details.

- Upload Required Documents – You submit your ID and proof of income.

- Review Your Information – You check if everything is correct.

- Submit Your Application – You send your form to Citibank for processing.

- Wait for Approval Notice – You receive the final decision from Citibank.

Tips to Get Approved Faster

You can improve your approval chances by preparing the correct information before you apply.

These tips keep your profile clean and make the review process smoother. Here are the steps you can follow.

- Check your credit score – Make sure it’s in good shape before applying.

- Update your income details – Provide recent and accurate income information.

- Pay off small balances – Lowering your credit usage improves your profile.

- Avoid multiple applications – Too many inquiries can slow down approval.

- Prepare complete documents – Have your ID and income proofs ready.

- Keep your contact details active – Ensure your phone and email are working for quick verification.

Fees and Interest Rates to Expect

Here are what you should look out for in fees and interest rates. They tell you how much owning a card may cost and how to avoid surprises.

- Annual Fee – The yearly charge for having the card, if any.

- Purchase APR (Annual Percentage Rate) – The interest rate you’ll pay if you carry a balance. For some cards, rates range around 18.24% to 28.24%.

- Cash Advance APR – A Higher interest rate for taking out cash with the card. E.g., up to ~29.99%.

- Foreign Transaction Fee – A fee applied to purchases made in other currencies or overseas; often % of the transaction.

- Late Payment Fee – A fixed fee or percentage charged if you miss the payment due date.

- Balance Transfer Fee – Fee charged when you transfer debt from another card; may be a percentage or a flat fee.

Pros and Cons of Citibank Credit Cards

Before you pick a card, weigh the benefits and drawbacks. Below you’ll find what works well and what could be an issue when using these cards.

Pros

- Strong rewards and perks – Many cards offer cash-back or travel points and useful bonuses.

- Good fraud protection – Your liability for unauthorized charges is minimal or zero.

- Helps build credit – If you use the card responsibly, your credit history can improve.

Cons

- Interest and fees can be high – If you carry a balance or do cash advances, costs add up fast.

- Rewards may have restrictions – Some cards limit how or when you redeem rewards, or cap bonus categories.

- Application and usage may affect your credit – Multiple applications or high credit usage can hurt your score.

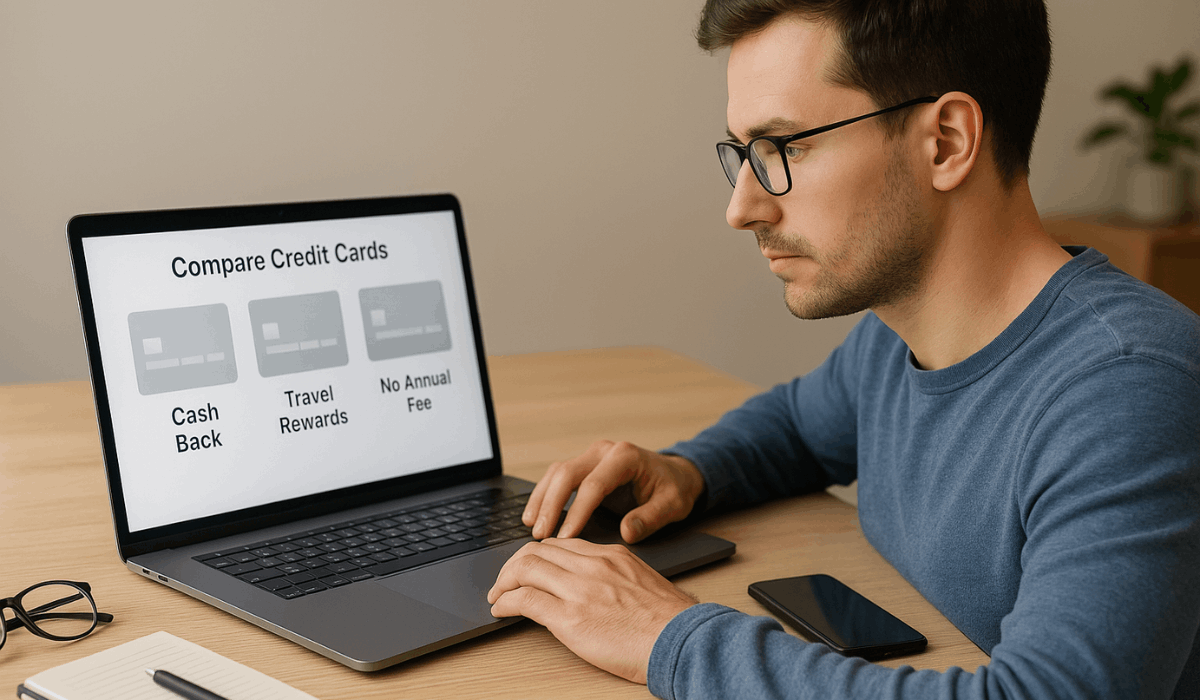

Who Should Choose a Cash Back Card vs. a Travel Card

Choosing between a cash back card and a travel card depends on how you spend and what benefits you prefer.

Each option works best for a different type of user. Here’s a simple guide to help you pick the right one.

Who Should Choose a Cash Back Card

- People who want simple rewards they can use anytime

- Those who spend more on everyday categories like groceries or gas

- Users who prefer lower or no annual fees

- Anyone who wants rewards without tracking points or miles

Who Should Choose a Travel Card

- Frequent travelers who book flights and hotels often

- Users who want perks like lounge access, travel insurance, or no foreign transaction fees

- People who travel internationally and want better redemption value

- Anyone comfortable managing points or miles for higher long-term rewards

Contact Information

You may need to reach customer support during your application or after getting your card.

These verified contact options help you get answers fast. Here’s the list you can use anytime.

- General Customer Service: 1-800-950-5114

- Spanish Customer Service: 1-800-947-9100

- Fraud/Reporting Security Issues: 1-800-248-4226

To Wrap Up

Citibank credit card options, requirements, and steps are now clear for easy comparison.

The details above make it simpler to choose the right fit based on rewards and spending habits.

Apply for a Citibank credit card today to start accessing its benefits.

Disclaimer

Information in this guide may change based on Citibank’s latest terms and policies.

Always review the official Citibank website before applying for any card.