The BOA Customized Cash Rewards Card gives you flexible ways to earn more cash back on everyday purchases.

This review explains how the 3% category works and what has changed for 2025. You will learn whether this card fits your spending habits.

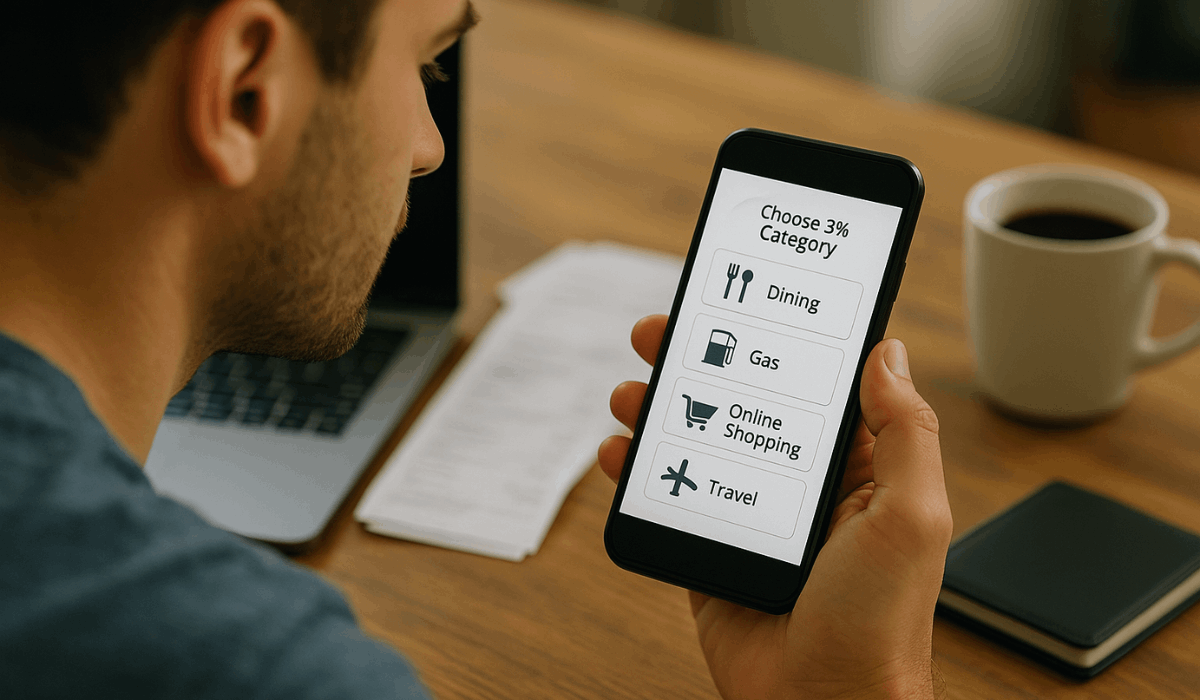

How the 3% Cash Back Works

Here’s how the 3% cash back works. This helps you understand how to set your category and get the highest value each month.

- You choose one 3% category, such as gas, online shopping, dining, travel, drugstores, or home improvement.

- You can switch your 3% category once every month through the mobile app or online banking.

- The 3% rate applies only up to the monthly bonus cap set by BOA.

- Purchases beyond the cap earn 1% cash back.

- Grocery stores and wholesale clubs earn 2%, also up to a separate cap.

- Cash back is calculated based on the posted transaction amount.

Key Benefits

These key benefits show you what the card offers and how it helps you earn more on daily spending. This gives you a quick view of the strongest features.

- Earn 3% cash back in the category you choose each month.

- Earn 2% cash back at grocery stores and wholesale clubs.

- Earn 1% cash back on all other purchases.

- Get higher reward rates if you are part of BOA Preferred Rewards.

- Redeem cash back as a statement credit or direct deposit.

- Use the mobile app to track and switch your cash-back category easily.

Rates and Fees (2025)

This section shows you the verified rates and fees for the BOA Customized Cash Rewards Card in 2025.

Each item shows the exact charge and a short description so you know what to expect.

- Purchase APR: 17.74% – 27.74% variable

- Introductory Purchase APR: 0% for the first 15 billing cycles

- Balance Transfer APR: 0% for eligible transfers made within the first 60 days, thereafter variable 17.74% – 27.74%.

- Balance Transfer Fee: 3% for transfers made within the first 60 days; afterwards, 4% of each transfer.

- Annual Fee: $0

- Foreign Transaction Fee: 3% of each foreign currency transaction

How to Apply Online

Here’s how you apply online for the BOA Customized Cash Rewards Card. This gives you a quick view of what you need and the steps you must follow.

- Check Eligibility: Ensure you meet the basic requirements, including being at least 18 years old and having a valid Social Security number.

- Prepare Documents: Have your ID, income details, employment info, and address ready.

- Visit the BOA Website: Go to the official Bank of America credit card application page.

- Fill Out the Form: Enter your personal, financial, and contact details accurately.

- Review and Submit: Confirm all information, then apply online.

- Wait for a Decision: You may receive instant approval or be asked for additional verification.

Pros and Cons

Understanding the pros and cons helps you see whether the BOA Customized Cash Rewards Card fits your spending style.

The points below clearly show the main strengths and limitations.

Pros:

- 0% annual fee with no yearly cost to keep the card active.

- 3% cash back in the category you choose each month.

- 2% cash back at grocery stores and wholesale clubs.

- Ability to switch your 3% category monthly.

- Higher cash-back rates if you are a BOA Preferred Rewards member.

Cons:

- Bonus categories have a quarterly spending limit.

- Earnings fall to 1% after reaching the cap.

- Best benefits require Preferred Rewards membership.

- Rewards system is more complex than flat-rate cards.

- Good to excellent credit is usually needed for approval.

Tips to Maximize the 3% Cash Back

Using the proper habits helps you get the full value of the 3% category. The tips below outline simple steps to increase your monthly earnings.

- Pick the right category: Choose the 3% option that matches your highest spending for the month.

- Check your cap: Track your spending so you don’t waste purchases that could earn higher rewards.

- Switch when needed: Change your 3% category monthly based on upcoming expenses.

- Use Preferred Rewards: Join the program if you qualify to boost your cash-back rate.

- Redeem on time: Claim your cash back regularly to see the benefit sooner.

- Use the BOA app: Monitor spending and category selection through the mobile app for better control.

Mobile App and Account Management

Managing your rewards through the BOA mobile app makes it easier to control your spending and switch categories on time.

The points below show the main tools you can use to stay organized.

- Track Rewards: See your 3%, 2%, and 1% earnings in real time.

- Change Your 3% Category: Switch your bonus category directly inside the app each month.

- Monitor Spending: View your transaction history to stay within the bonus cap.

- Redeem Cash Back: Redeem your rewards as a statement credit or deposit with a few taps.

- Set Alerts: Get notifications for payments, spending, and posted rewards.

- Use Security Tools: Enable card lock, alerts, and transaction verification for added protection.

Best Time to Use Each Category

Using the right category at the right time helps you get the full value of the 3% rate.

The points below show when each category gives you the strongest return.

- Gas: Best during months when you expect long drives, trips, or increased commuting.

- Online Shopping: Ideal during holiday seasons, significant sale events, and months when you buy household items online.

- Dining: Useful for planning birthdays, family meals, social events, or frequent restaurant visits.

- Travel: Strongest during vacation periods, long weekends, and months with planned flights or hotels.

- Drugstores: Effective when you have medical purchases, seasonal health needs, or regular pharmacy trips.

- Home Improvement: Best during renovation months or when buying tools, paint, or furniture.

Comparison with Other Cash-Back Cards

A quick comparison helps you see how the BOA Customized Cash Rewards Card stacks up against other options.

These points clearly show the main differences.

- Chase Freedom Flex: Rotating 5% categories; BOA lets you pick a steady 3% monthly.

- Citi Custom Cash: Auto 5% top category; BOA requires manual 3% selection.

- Discover it Cash Back: Quarterly 5% rotations; BOA gives consistent monthly control.

- Wells Fargo Active Cash: Flat 2% on everything; BOA offers higher targeted rewards.

- Capital One SavorOne: Strong dining and entertainment; BOA is more flexible with monthly payments.

- Amex Blue Cash Everyday: Fixed high-value categories; BOA allows monthly switching.

Contact Information

You’ll need the correct contact details to get help or manage your account effectively.

Here are key phone numbers and addresses for the BOA Customized Cash Rewards Card.

- Phone (General Credit Card Service): 1-800-732-9194

- Phone (Outside U.S.): 302-738-5719

- Activate New Card: 800-276-9939

- Fraud / Suspicious Activity: 800-432-1000

- Official Website (for account management & contact): bankofamerica.com

To Wrap Up

The BOA Customized Cash Rewards Card gives you strong value when you use the 3% category wisely.

It works best when you match the rewards to your monthly spending habits.

Apply for the BOA Customized Cash Rewards Card today if you want flexible cash back that fits your routine.

Disclaimer

Rates, fees, and card details may change at any time in accordance with Bank of America’s updates.

Always check the official BOA website for the most current information before applying.